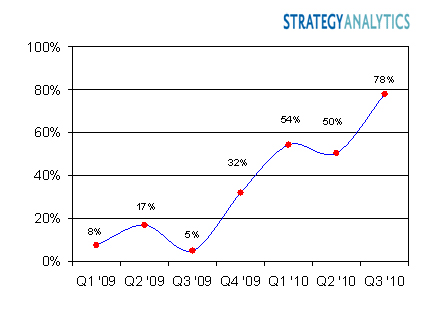

Figures from analysts Smart Analytics confirm earlier figures from ABI Research that smartphone sales are continuing to increase at supersonic rates.

The Smart Analytic Q3 figures show global shipments of smartphones reached a record 77 million units and annual growth hit an impressive 78%. Apple was the best performer and has overtaken RIM and is closing the gap on Nokia to the smallest level since first entering the mobile market in 2007.

Global smartphone volumes rose a huge 78% annually to 77 million units during Q3 2010. Smartphones made up 23% of total worldwide handset volumes during the quarter, leaping from 20% in the prior quarter. Sales were driven heavily by Apple and by several major Android players expanding their smartphone ranges such as Samsung and HTC.

Despite moderate component shortages in application processors and touchscreens, global smartphone shipment growth reached 78% annually in Q3 2010, its fastest rate since the mid-2000s.

Nokia

In Q3 the number one performer was Nokia, the Nordic giant shipped a record 26.5 million smartphones worldwide in Q3 2010, rising 61% from 16.4 million units a year earlier. A figure that’s sure to rise as the new Nokia N8 goes on sale, although it’s late in the quarter so it may not appear quite as big as it could in Q4. While there were record volumes, the sales were not enough to prevent Nokia’s global marketshare slipping to a low of 34%. Nokia is facing competition not just from Apple and RIM but also from a wave of ambitious Android players such as Samsung, HTC and Sony Ericsson. Nokia was shipping 3 times more smartphones than Apple last year but that ratio has now fallen to two times.

Apple

Apple shipped a larger-than-expected 14.1 million iPhones worldwide in Q3 2010, almost doubling from 7.4 million units a year earlier, increasing it’s marketshare to a record high of 18% during the quarter. Key markets for Apple included the USA, UK, France and Japan. While Apple’s main hardware competitors remain Nokia and RIM, both Samsung and HTC are rapidly expanding their Android portfolios and attempting to close the gap on Apple.

RIM

RIM shipped 12.4 million smartphones worldwide during Q3 2010, up from 8.5 million units a year earlier. RIM’s annual growth rate improved to 46% during the quarter, its highest level since Q1 2009. International expansion is feeding the growth, with volumes outside North America now making up 52% of its worldwide total. However, its global smartphone marketshare has edged down from 19% to 16% during the past 12 months.

Q3 2010 Global Smartphone Shipments and Market Share Estimates – Top 3 Vendors

| Global Smartphone Vendor Shipments (Millions of Units) | Q3 ’09 | Q4 ’09 | 2009 | Q1 ’10 | Q2 ’10 | Q3 ’10 |

| Nokia | 16.4 | 20.8 | 67.8 | 21.5 | 23.8 | 26.5 |

| Apple | 7.4 | 8.7 | 25.1 | 8.8 | 8.4 | 14.1 |

| RIM | 8.5 | 10.7 | 34.5 | 10.6 | 11.2 | 12.4 |

| Others | 11.1 | 13.7 | 47.3 | 14.5 | 19.0 | 24.1 |

| Total | 43.4 | 53.9 | 174.7 | 55.4 | 62.4 | 77.1 |

| Global Smartphone Vendor Marketshare % | Q3 ’09 | Q4 ’09 | 2009 | Q1 ’10 | Q2 ’10 | Q3 ’10 |

| Nokia | 37.8% | 38.6% | 38.8% | 38.8% | 38.1% | 34.4% |

| Apple | 17.0% | 16.1% | 14.4% | 15.9% | 13.5% | 18.3% |

| RIM | 19.6% | 19.9% | 19.7% | 19.1% | 17.9% | 16.1% |

| Others | 25.6% | 25.4% | 27.1% | 26.2% | 30.4% | 31.3% |

| Total | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% | 100.0% |