It’s interesting to see that on the day that Google’s CEO announces a new mobile phone, complete with Near Field Communication (NFC) that the three US major networks launch a joint venture to promote NFC. Could they be linked? It’s also interesting to see how the US is going about using NFC in mobile compared to the UK.

It’s interesting to see that on the day that Google’s CEO announces a new mobile phone, complete with Near Field Communication (NFC) that the three US major networks launch a joint venture to promote NFC. Could they be linked? It’s also interesting to see how the US is going about using NFC in mobile compared to the UK.

The Joint venture in question is Isis, a US mobile commerce network formed by AT&T Mobility, T-Mobile USA and Verizon Wireless and established to “fundamentally transform how people shop, pay and save”. Now that’s a tall order, and something that nobody has managed to do convincingly in the West. The Far East has so far been the leader in this field.

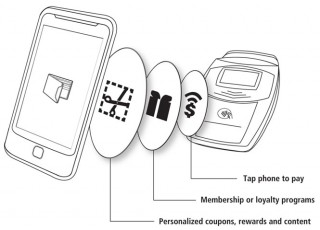

According to the aims of the consortium, Isis’ initial focus will be on building a mobile payment network that utilises mobile phones to make point-of-sale purchases, and it’s going to do this by utilising smartphone and near-field communication (NFC) technology. Which is what everyone else worldwide is planning on doing, although unlike the UK the networks are working together to achieve this, which is at least half of the battle won.

Heavyweight CEO

It’s also aiming to introduce its service in key geographic markets during the next 18 months, where as the UK networks are cagey over when and how they will be doing this. Isis has also brought in some heavyweights. Former GE Capital executive, Michael Abbott has been named as Chief Executive Officer of Isis.

“Our mobile commerce network, through relationships with merchants, will provide an enhanced, more convenient, more personalised shopping experience for consumers,” said Michael Abbott, Chief Executive Officer of Isis. “While mobile payments will be at the core of our offering, it is only the start. We plan to create a mobile wallet that ultimately eliminates the need for consumers to carry cash, credit and debit cards, reward cards, coupons, tickets and transit passes.”

Over 200 million on start-up

When Isis goes live in 18 months it will have the combined weight of the 200 million consumers from AT&T Mobility, T-Mobile USA and Verizon Wireless, along with the Discover Financial Services’ payment network, currently accepted at more than seven million merchant locations nationwide, and ironically Barclaycard US, – the US arm of the Barclays – is expected to be the first issuer on the network.

“We believe the venture will have the scope and scale necessary to introduce mobile commerce on a broad basis. In the beginning, we intend to fully utilize Discover’s national payment infrastructure as well as Barclaycard’s expertise in contactless and mobile payments,” said Abbott. “Moving forward, Isis will be available to all interested merchants, banks and mobile carriers.”

The shambles of the UK

In Europe there’s currently a small trial in the Spanish city of Stiges, where, Visa have teamed up with Spanish savings bank La Caixa and mobile phone company Telefónica, owner of 02 in the UK, and if it all goes according to plan, they will roll out something in the next 30 months. If the lessons of the continuing MMS screw up are anything to go by, then in five years time we will still be talking about it, the networks will still be arguing over how to do it, while the rest of the world happily does it.

We’re planning on emigrating to the US